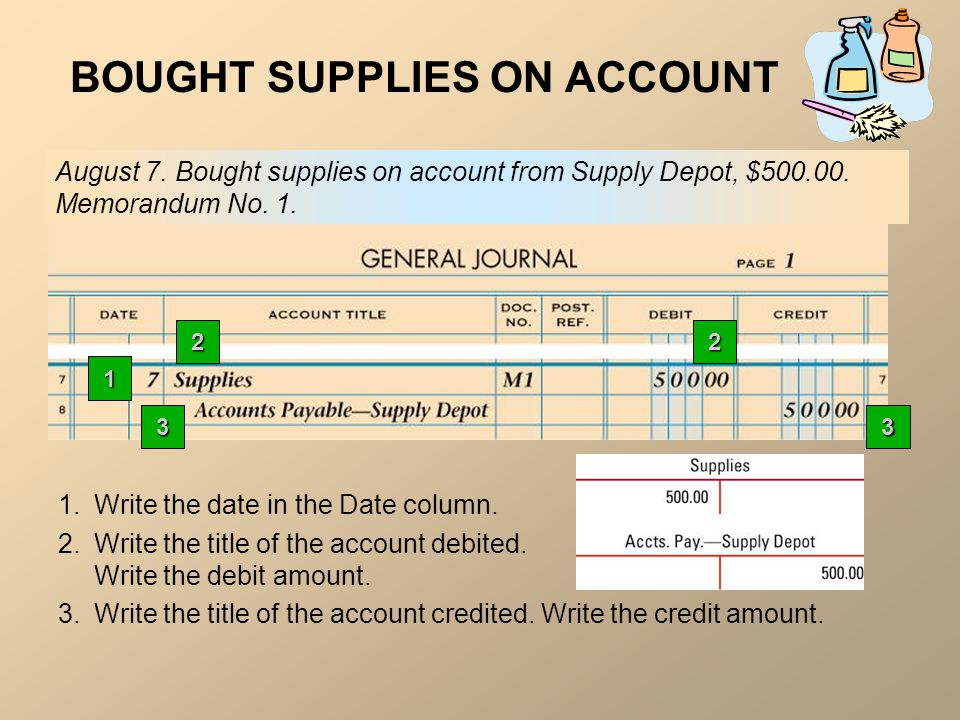

And so it is recorded as a liability of the company. Third to record the cash payment on the credit purchase of supplies.

Recording Purchase Of Office Supplies On Account Journal Entry

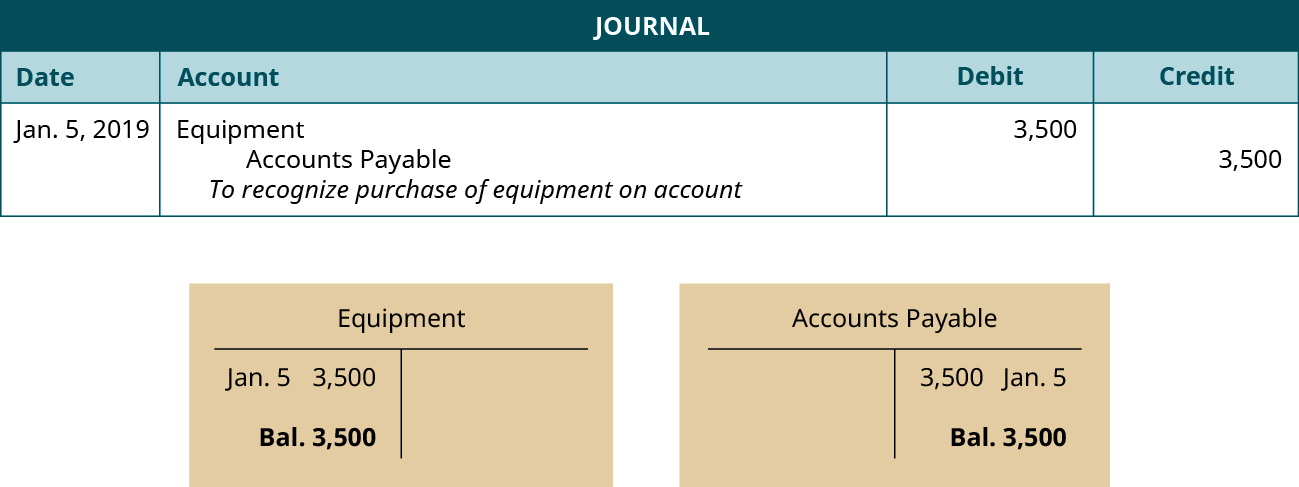

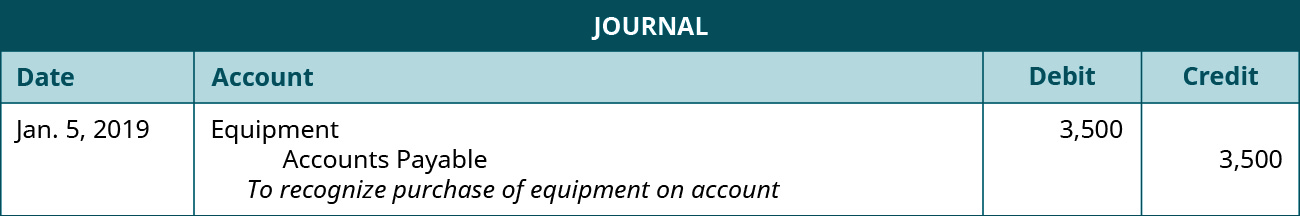

Purchased Equipment on Account Journal Entry.

. Golden rules of accounting applied UK Style Purchase AC Type Nominal Rule Dr. In business the company usually needs to purchase office supplies for the business operation. They also record the accounts payable as the purchase is made on the account.

Double-entry bookkeeping in accounting is a system of bookkeeping so named because every entry to an account requires a corresponding and opposite entry to a different account. -- Increase in Liabilities. Common Stock has a credit balance of 20000.

Accounts Payable Supply Company 165000. In the journal entry Cash has a debit of 20000. Office supplies used Beginning office supplies Bought-in office supplies Ending office supplies Office supplies used 1000 800 500 1300 Likewise the company ABC can make the journal entry for 1300 of the office supplies used during the period as below.

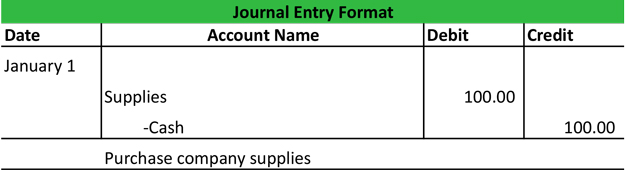

Journal entries are the way we capture the activity of our business. Say you sell the computers for 4000. Likewise when it paid cash for supplies it needs to make a proper journal entry based on whether it is on the purchasing date or it is on a later date for settlement the payable it has made on the purchasing date.

Thus consuming supplies converts the supplies asset into an expense. Purchased Goods on Credit. This is posted to the Cash T-account on the debit side left side.

On January 3 2019 issues 20000 shares of common stock for cash. Supplies expense Beginning supplies on hand Purchases - Ending supplies on hand Supplies expense 1200 400 - 900 Supplies expense 700. They need to settle the payable later.

This data can help save money and increase profit margins but only if you carefully specify which transactions to. Journal entry for credit purchase. The Increase in Expenses.

If this journal entry is not made both total assets and total liabilities on the balance sheet of the company ABC will be understated by 800. To show this journal entry use four accounts. Company ABC purchased Office supplies costing 2500 and paid in cash.

When the company ABC makes the payment for the supplies bought on January 28 2021 it can make the journal entry to eliminate the 800 payable as below. Cash balance increases by 20000. Gain on Asset Disposal.

All Expenses and Losses. Second to record the return of supplies. Despite the temptation to record supplies as an asset it is generally much easier to record supplies as an expense as soon as they are purchased in order to avoid tracking the amount and cost of supplies on hand.

On February 26 2021. First to record the purchase of supplies on credit. For this transaction the accounting equation is shown in the following table.

The company purchased 12000 equipment and paid in. Prepare a journal entry to record this transaction. Debit your Cash account 4000 and debit your Accumulated Depreciation account 8000.

When a business transaction requires a. Also on December 7 Gray Electronic Repair Services purchased service supplies on account amounting to 1500. The computers accumulated depreciation is 8000.

By the terms on account it means that the amount has not yet been paid. Q2 The entity purchased 150000 new equipment on account. Description of Journal Entry.

Accounts Payable Supply Company 20000. The following are the journal entries recorded earlier for Printing Plus. Suppose in the above example the beginning supplies on hand were 1200 and the ending supplies on hand were 900 then the supplies expense for the period would be calculated as follows.

When the company purchases equipment the accountant records it into the balance sheet under fixed assets section. Whenever credit purchase takes place accounts payable accountsundry creditor is created. Results of Journal Entry.

Borrowings balance increases by 10000. Paid Cash for Supplies Accounting Equation. Lets say you sell your asset and end up making money.

Modern rules of accounting applied US-Style Purchase AC Type Expense Rule Dr. This lesson will cover how to create journal entries from business transactions. With the help of a spreadsheet or accounting software you can also use journal entries to track trends relating to money spent and money received.

The company received supplies thus we will record a debit to increase supplies. Also charging supplies to expense allows for the avoidance of the fees. Purchase Of Office Supplies Journal Entry.

Paid cash for supplies journal entry. The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business This is true at any time and applies to each transaction. Creditors AC Type Personal Rule Cr.

Accounts Payable Supply Company 185000. -- Increase in Assets. In simple terms when an organization or customer purchases the goods from the seller or supplier and agrees to pay the consideration value or price of the goods on some future date then it is called credit purchases.

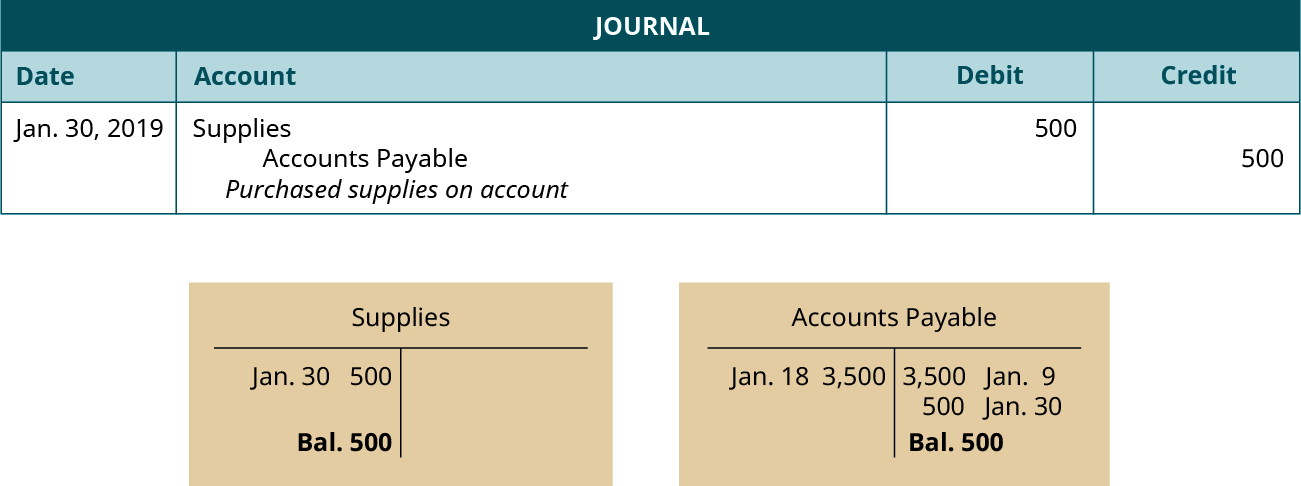

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

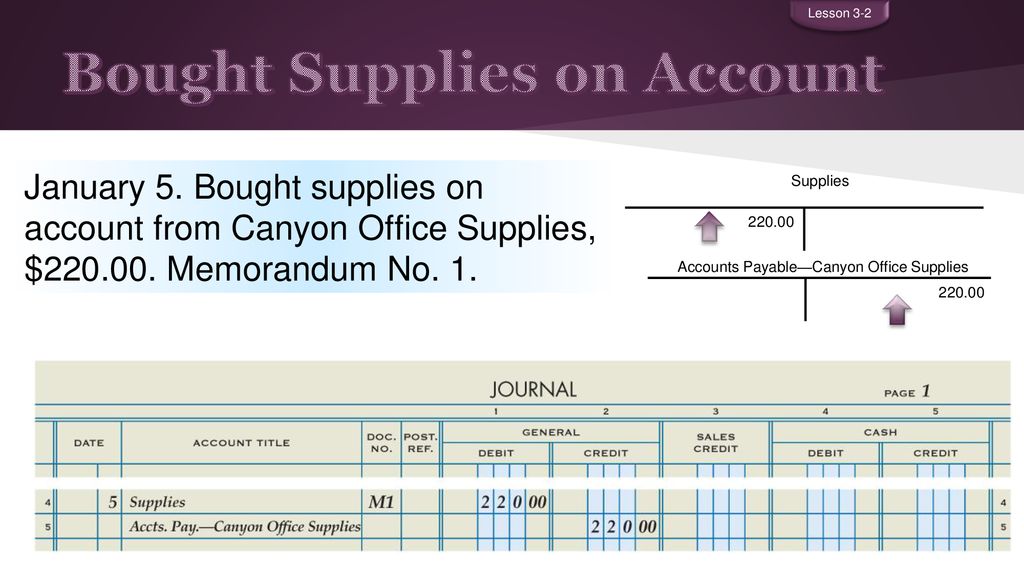

Unit 5 The General Journal Journalizing The Recording Process Ppt Download

Business Events Transaction Journal Entry Format My Accounting Course

Paid Cash For Supplies Double Entry Bookkeeping

Chapter Journal Review Ppt Download

Purchase Office Supplies On Account Double Entry Bookkeeping

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

0 comments

Post a Comment